SMALL-BUSINESS BOOKKEEPING

With a BIG Impact.

What you get with Small-Books

Small-Books helps small business owners like you save time and money doing your bookkeeping and income taxes.

By pairing entrepreneurs with dedicated small business experts and easy-to-use financial software—

we take care of the numbers, so you can take care of business.

Tax season, minus the stress

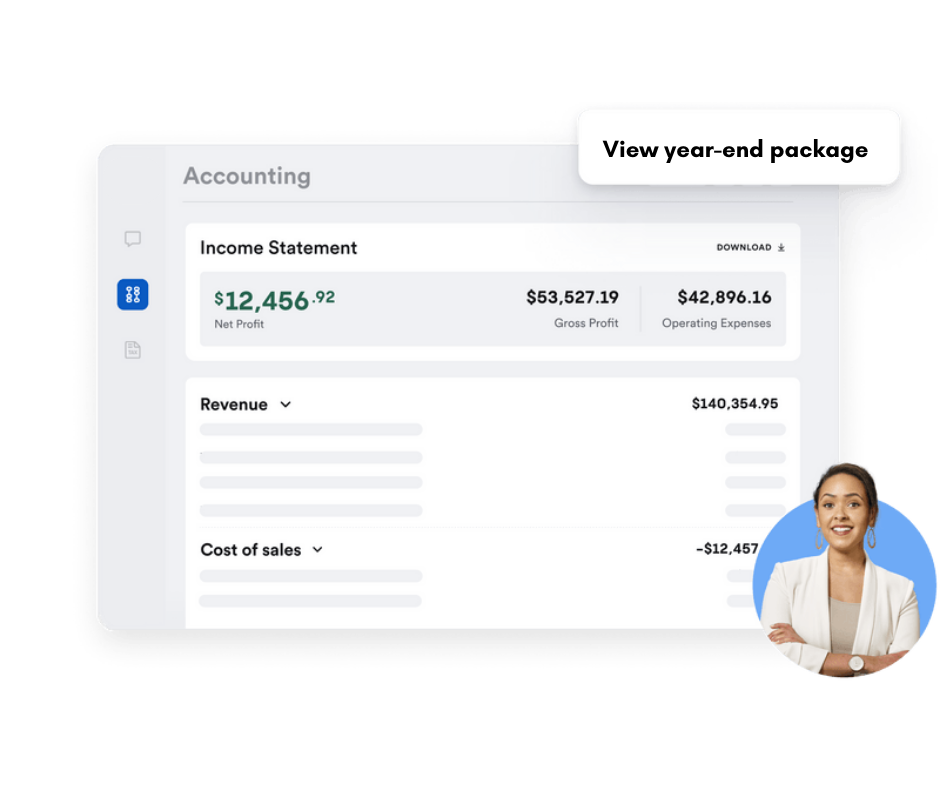

A year end package with everything you need to file comes standard with Small-Books. Upgrade your plan, and cross even more off your to-do list. With Premium, you get expert tax prep, filing, and year-round tax advisory support.

Real-time insights at your fingertips

Easily see your updated financial data every month. With real-time insights, you can make on-the-fly decisions about where to spend and where to save, helping your business stay on budget.

One-on-one expert support

Small-Books gives you a dedicated bookkeeper supported by a team of knowledgeable small business experts. Get a direct line to your team on desktop or mobile—professional support is just a few swipes, taps, or clicks away.

Our Services

Monthly

Bookkeeping

With the Small-Books Plan, we will take over all the time-consuming responsibilities of bookkeeping, provide you with monthly financials, GST/HST reporting, and income tax preparation; all for one fixed monthly fee—no surprises.

Backdated Bookkeeping

Feel like you’re drowning in overdue bookkeeping? CRA banging down your door for overdue tax filings? Small-Books has you covered with our Back-Date program. Leave it to the experts to get your books up-to-date and ready to file—fast!

Tax Services

We’re the firm that seamlessly handles everything for you, from your monthly bookkeeping, GST/HST preparation and filings, to personal and corporate taxes. No need to shuffle paper between your bookkeeper and your accountant!

Payroll

Say goodbye to your payroll struggles. Our payroll specialists ensure accurate and on-time payroll processing, issue T4s at year end, and more. Whether it’s WSIB, onboarding, or issuing T4s, we take care of it. Making both payday and year end a piece of cake!

Explore resources for managing small business finances

Small-Books LEARN.

We partner with the best in small business

Frequently Asked Questions

-

Your bookkeeper reconciles your accounts, categorizes your transactions, and produces your financial statements. They also make adjustments to your books to ensure they’re tax-compliant. Occasionally your bookkeeper might need your input on things like categorizing a transaction properly, but we try our best to make bookkeeping as hands-off as possible for you.

You can also book a call with your bookkeeper (or send them a message) whenever you’d like. There’s no extra fee or hourly charges for support—we’re always happy to nerd out about bookkeeping and your financial statements.

-

Each customer’s main point of contact is a dedicated, Small-Books Certified Small Business Bookkeeper (CSBB). They will get to know your business inside and out and ensure all your bookkeeping questions are answered in full.

Small business bookkeeping is a specific and very important practice, so we ensure that our bookkeepers have the most up-to-date knowledge and qualifications to do the job right. They must complete our proprietary Small-Books CSBB course and successfully achieve the certification in order to work with clients. This allows us to ensure every touch point of our client’s books are up to the Small-Books highest standard of service.

And, as always, every customer’s books undergo quality reviews to ensure we’re meeting our commitment of providing accurate and compliant books. All parties and practices that support Small-Books also adhere to our strict data security protocols.

-

When we get you set-up for bookkeeping, we will have you login to your business bank account from your accounting software. By linking your bank account, it will allow us to securely download your banking transactions and bank statements (without the need for you to share any sensitive login information!). This feature saves you the time and effort of manually uploading bank statements each month.

We can even connect with your credit card, Stripe, Square, Shopify, and PayPal accounts!

We also support clients that use other merchant processors. We’ll work with you to connect accounts and pull the data we need to reconcile your books.

-

This is one of our favorite parts!

Small-Books is a cloud-based bookkeeping solution, meaning we can help you go paperless. It’s better for the planet - and your peace of mind. Less “doom piles” of receipts, and everything you need in case of an audit will be perfectly organized on the cloud.

Any receipts and documentation can be easily and securely scanned right into your accounting software. Just snap a picture on your phone or forward a digital receipt from your email, and we will take care of the rest!

-

Yep! No matter how far behind you are (yes, even years behind), we can get you caught up quickly and help keep your books up-to-date moving forward!

Need more than two years of historical bookkeeping? Our Small-Books Retro team can work with you to get caught up for dissolving your business, filing for bankruptcy, or creating an CRA payment plan.

-

There’s no catch! Part of what makes Small-Books unique is that we blend together the human touch with modern technology. Our team is also supported by machine learning technology, which allows us to automatically process large amounts of financial data instantly, plus teams of external data processors that help us process financial data and close your books faster and accurately. That leaves us more time to attend personally to the questions and needs of our clients. So you get the big business service, at small business pricing!